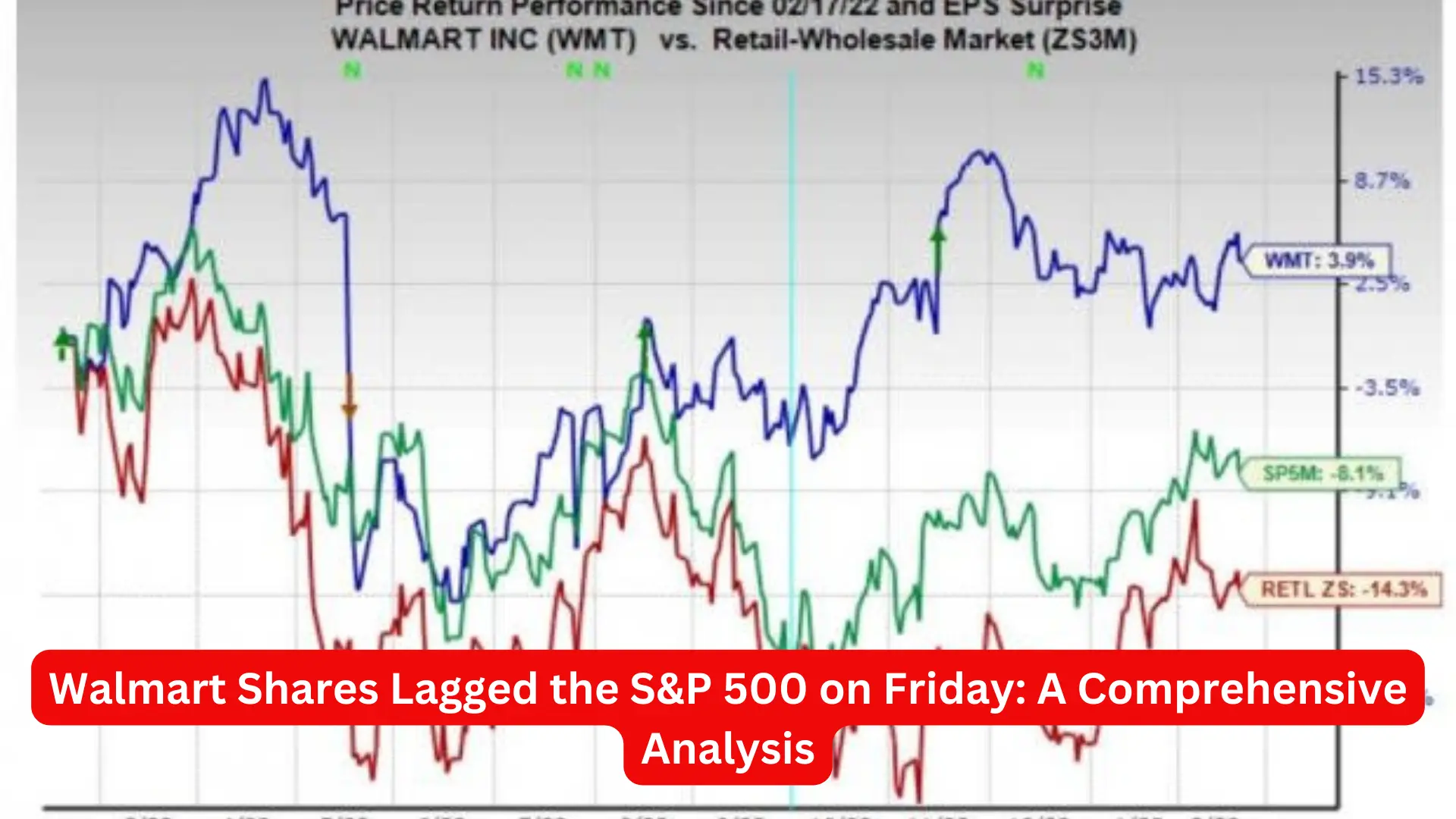

Walmart Shares Lagged the S&P 500 on Friday: A Comprehensive Analysis

On Friday, Walmart Inc. (WMT) shares experienced a significant underperformance compared to the broader S&P 500 index. This trend caught the attention of investors and market analysts, as Walmart is a major player in the retail sector. In this article, we will delve into the details of Walmart’s stock performance, analyze the contributing factors, and provide a broader context of the retail and economic environment.

Walmart’s Market Performance on Friday

On the trading day in question, Walmart’s shares closed at $157.34, marking a decline of 1.17%. In contrast, the S&P 500 saw a modest gain of 0.85%, highlighting a stark underperformance by Walmart. This divergence in performance is significant for investors, as it underscores potential concerns or specific challenges faced by Walmart in the current market landscape.

Analyzing the Factors Behind Walmart’s Underperformance

Several factors contributed to Walmart’s lagging performance on Friday. We will explore these factors in detail to understand the broader implications for the company’s stock and the retail sector as a whole.

1. Economic Indicators and Consumer Spending

Economic indicators play a crucial role in influencing the performance of retail stocks like Walmart. Recent data suggested a slowdown in consumer spending, which directly impacts retail giants. The Consumer Confidence Index (CCI) showed a decline, indicating that consumers are becoming more cautious with their spending. This trend is particularly concerning for Walmart, which relies heavily on consumer spending for its revenue.

2. Competitive Pressure in the Retail Sector

The retail sector is highly competitive, with major players like Amazon, Costco, and Target constantly vying for market share. On Friday, Walmart faced heightened competitive pressure, which likely contributed to its stock’s underperformance. Amazon reported better-than-expected quarterly earnings, boosting investor confidence in its stock and drawing attention away from Walmart.

3. Supply Chain Challenges

Supply chain disruptions have been a persistent issue for retailers, and Walmart is no exception. The ongoing challenges in global supply chains have led to increased costs and delays in inventory replenishment. On Friday, reports indicated that Walmart was experiencing delays in key product categories, leading to concerns about its ability to meet consumer demand during the critical back-to-school shopping season.

4. Inflationary Pressures

Inflation has been a significant concern for both consumers and businesses. Rising costs for goods and services have forced retailers to adjust their pricing strategies. Walmart, known for its commitment to offering low prices, faces a delicate balancing act. On Friday, inflationary pressures likely contributed to investor concerns about Walmart’s margins and profitability.

5. Walmart’s Earnings Report and Guidance

Earnings reports and forward guidance are critical drivers of stock performance. In its most recent earnings report, Walmart provided guidance that was slightly below analyst expectations. This cautious outlook may have contributed to the negative sentiment surrounding the stock on Friday. Investors often react strongly to any signs of potential weakness in a company’s future performance.

6. Market Sentiment and Investor Behavior

Market sentiment and investor behavior can have a profound impact on stock performance. On Friday, there was a notable shift in investor sentiment, with a preference for technology and growth stocks over traditional retail stocks like Walmart. This shift in sentiment can lead to short-term underperformance, even if the company’s fundamentals remain strong.

7. Geopolitical and Regulatory Concerns

Geopolitical and regulatory concerns also play a role in shaping the performance of stocks. Recent developments in trade policies and regulatory scrutiny on large corporations have added a layer of uncertainty to the market. Walmart, with its extensive global operations, is particularly sensitive to these external factors. On Friday, news of potential regulatory actions may have weighed on investor sentiment.

Broader Retail Sector Context

To fully understand Walmart’s underperformance, it is essential to consider the broader context of the retail sector. The retail industry is undergoing significant transformations, driven by changing consumer behaviors, technological advancements, and evolving market dynamics.

E-commerce Growth and Digital Transformation

E-commerce has been a major driver of growth in the retail sector. Walmart has made substantial investments in its digital infrastructure to compete with online giants like Amazon. However, the rapid growth of e-commerce also brings challenges, such as increased competition and the need for continuous innovation. On Friday, the focus on e-commerce growth may have led investors to prioritize stocks with stronger online presence.

Sustainability and Corporate Responsibility

Sustainability and corporate responsibility are increasingly important to consumers and investors. Walmart has implemented several initiatives to reduce its environmental footprint and enhance its social impact. However, these efforts also come with costs and operational challenges. On Friday, any perceived shortcomings in Walmart’s sustainability initiatives may have influenced investor sentiment.

Consumer Trends and Preferences

Understanding consumer trends and preferences is critical for retailers. The pandemic has accelerated shifts in consumer behavior, with more people shopping online and prioritizing convenience and safety. Walmart has adapted to these changes, but ongoing shifts in consumer preferences require continuous adaptation and investment. On Friday, concerns about Walmart’s ability to keep pace with these changes may have affected its stock performance.

Conclusion

Walmart’s underperformance on Friday, relative to the S&P 500, can be attributed to a combination of economic indicators, competitive pressures, supply chain challenges, inflationary pressures, earnings reports, market sentiment, and geopolitical concerns. While these factors present challenges, they also highlight the complex and dynamic nature of the retail sector.

Investors should consider the broader context and long-term prospects of Walmart when assessing its stock performance. The company’s strategic initiatives, commitment to sustainability, and ability to adapt to changing consumer trends will play a crucial role in its future success.