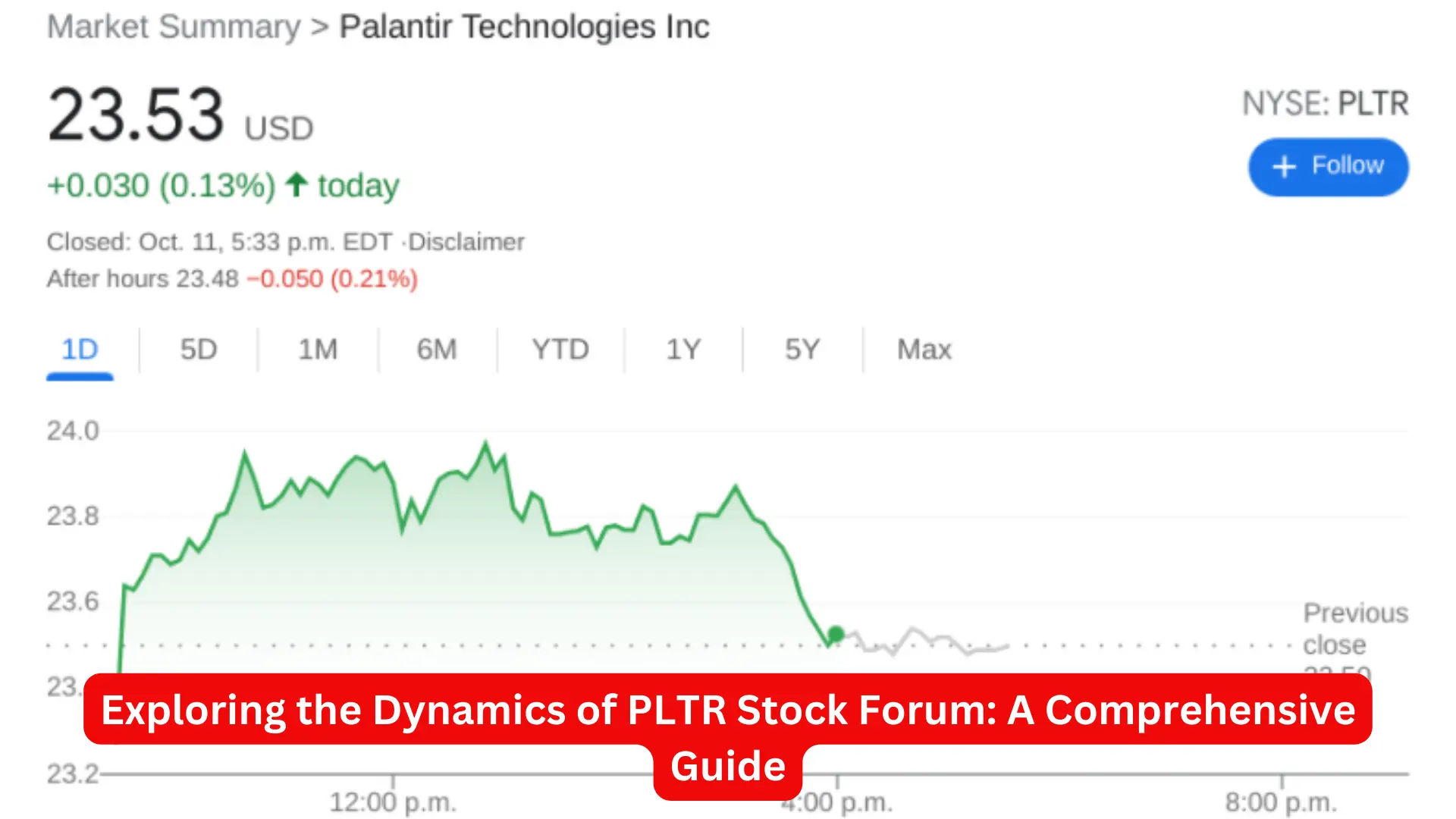

Exploring the Dynamics of PLTR Stock Forum: A Comprehensive Guide

Palantir Technologies Inc. (PLTR) has become a focal point for investors and market analysts alike, making the PLTR stock forum a vibrant hub for discussions and insights. As we delve into the intricacies of PLTR stock, it’s essential to understand the factors driving its market performance, the community sentiment, and the strategic insights shared within these forums. This guide aims to provide a detailed examination of these elements, helping you navigate the complex landscape of Palantir stock investments.

Understanding Palantir Technologies Inc. (PLTR)

Company Overview

Palantir Technologies Inc. is a public American software company that specializes in big data analytics. Founded in 2003 by Peter Thiel, Nathan Gettings, Joe Lonsdale, Stephen Cohen, and Alex Karp, Palantir has developed a reputation for its data integration and analysis capabilities. The company operates primarily through two segments: Palantir Gotham and Palantir Foundry.

- Palantir Gotham: Designed for government operations, Gotham enables users to identify patterns in data sets, ranging from signals intelligence sources to reports from confidential informants. It is widely used by defense and intelligence agencies.

- Palantir Foundry: Targeted towards commercial clients, Foundry transforms the way organizations operate by creating a central operating system for their data.

Stock Performance Analysis

Since its direct listing on the New York Stock Exchange (NYSE) in September 2020, PLTR stock has experienced significant volatility. The stock’s performance is often influenced by various factors including quarterly earnings reports, changes in government contracts, and overall market sentiment towards tech stocks.

Recent Trends

- Quarterly Earnings: Analyzing recent earnings reports, PLTR has shown consistent revenue growth but also faces scrutiny over its profitability and stock-based compensation expenses.

- Government Contracts: Palantir’s extensive contracts with government agencies, particularly in defense and intelligence, play a crucial role in its revenue streams.

- Market Sentiment: Investor sentiment, often reflected in forums and social media platforms, can significantly impact PLTR stock prices. Bullish sentiments are typically driven by strategic partnerships and product innovations, while bearish sentiments often stem from concerns over valuation and long-term profitability.

Engaging with the PLTR Stock Forum Community

The Role of Stock Forums

Stock forums like StockTwits serve as a platform for investors to share their insights, analyses, and predictions about PLTR stock. These forums are valuable for gathering diverse opinions and staying updated with real-time market movements.

Key Features of StockTwits

- Real-Time Discussions: Investors share their thoughts and reactions to market events as they happen, providing a pulse on the market sentiment.

- Analytical Insights: Many forum participants are seasoned traders and analysts who offer in-depth analyses and forecasts.

- Community Polls: Periodic polls on stock forums can gauge the collective sentiment of the community towards PLTR stock.

Sentiment Analysis

Monitoring the sentiment within the PLTR stock forum can provide valuable insights into potential stock movements. Sentiment analysis involves evaluating the tone and content of posts to determine whether the overall community outlook is positive, negative, or neutral.

Bullish vs. Bearish Sentiments

- Bullish Sentiments: Positive outlooks are often driven by favorable earnings reports, new government contracts, strategic partnerships, and product advancements.

- Bearish Sentiments: Negative sentiments may arise from disappointing earnings, contract losses, insider selling, or broader market downturns.

Top Contributors

Identifying and following top contributors within the PLTR stock forum can enhance your understanding of the stock’s dynamics. These contributors often have a track record of accurate predictions and valuable insights.

Strategic Insights for PLTR Stock Investments

Fundamental Analysis

Conducting a fundamental analysis involves examining Palantir’s financial statements, revenue streams, market position, and competitive landscape. Key metrics to consider include:

- Revenue Growth: Analyzing year-over-year revenue growth to assess the company’s ability to scale its operations.

- Profit Margins: Evaluating operating and net profit margins to determine profitability.

- Cash Flow: Understanding cash flow from operations to gauge financial health and sustainability.

Technical Analysis

Technical analysis involves studying historical price and volume data to predict future stock movements. Common tools and indicators used include:

- Moving Averages: Analyzing short-term and long-term moving averages to identify trends.

- Relative Strength Index (RSI): Measuring the speed and change of price movements to identify overbought or oversold conditions.

- Support and Resistance Levels: Identifying key price levels where the stock has historically had difficulty moving above (resistance) or below (support).

Risk Management

Effective risk management strategies are crucial for navigating the volatility of PLTR stock. Key strategies include:

- Diversification: Avoiding overexposure to a single stock by diversifying your portfolio across different sectors.

- Stop-Loss Orders: Setting stop-loss orders to limit potential losses in case the stock moves against your position.

- Regular Monitoring: Continuously monitoring market conditions, company news, and forum sentiment to make informed decisions.

Conclusion

The PLTR stock forum serves as a valuable resource for investors looking to gain insights and share information about Palantir Technologies Inc. By engaging with the community, conducting thorough fundamental and technical analyses, and employing effective risk management strategies, investors can navigate the complexities of PLTR stock investments. Staying informed and proactive is key to making sound investment decisions in this dynamic market.